Jumpstart: What Q2 Earnings Reports Say About the Future of Streaming

This week on Hollywood Signal: Big Tech’s Q2 earnings reshape the industry playbook. Apple reins in TV+ losses. Amazon bets on sports and ads. Meanwhile, Fantastic Four powers up, and Paramount’s last solo report hits before its Skydance merger. Profit is the new protagonist.

Good morning — you’re reading the Jumpstart edition of Hollywood Signal, where we decode the power plays shaping the week ahead across the Business.

Some of the topics explored below: Fantastic Four cracks $118M domestic as it rides IMAX dominance, while Marvel quietly accelerates Eyes of Wakanda into a crowded August. But beyond the box office, a bigger story is taking shape: Big Tech is rewriting the rules of entertainment.

Thursday’s earnings blitz from Apple, Amazon, Paramount, and Comcast will offer a sweeping view of a sector in transition—from spend-first streaming to profit-bound pipelines. Apple’s TV+ losses, Amazon’s sports-and-ads pivot, and Paramount’s final solo earnings pre-merger all signal the same thing: The money is watching now. So are regulators. And so is everyone who wants to survive this new age of discipline.

In this edition:

- The Pulse: Fantastic Four’s opening flex, streaming’s dominance, and gas prices fueling Q3 theater legs

- Signals to Watch: Paramount–Skydance merger milestone, South Park’s $1.25B play, and Netflix’s Venice comeback

- Release Radar: Bad Guys 2 storms into pre-sales lead, Comic-Con fallout, and SIGGRAPH’s stealth tech courtships

- Feature Analysis: Why Apple and Amazon’s earnings aren’t just financials—they’re the script notes for Hollywood’s next act

Have a trend or release you want tracked in next Monday’s edition? Hit reply. We read every one.

60-Second Market Pulse

Quick data hits on the industry — Week of 28 Jul '25

YEAR TO DATE

$4.98B

2025 domestic box office through Jul 27

VIEWERSHIP

46.2%

Share of all U.S. TV time logged by streaming in June

Streaming beats cable + broadcast again

ECONOMY

$3.12/gal

U.S. regular gas average (AAA)

🎬 THE PULSE: Fantastic Four powers a midsummer surge, streaming holds nearly half of TV time, and lower gas prices keep audiences on the move.

Signals to Track

Bad Guys 2 Pre-Sales Surge

BoxofficePro’s latest long-range forecast (published Friday) lifts the animated sequel’s domestic opening projection to $25 – $35 million, surpassing the first film and vaulting it ahead of The Naked Gun as August’s family four-quadrant anchor. Exhibitors say group bookings from summer camps are running 20 % higher than for Elio earlier this month. BoxOffice Pro

Paramount-Skydance Merger Cleared

U.S. regulators have approved the $8 billion Paramount–Skydance deal, removing the last federal hurdle. The FCC sign-off sets an August 7 closing and triggers this Thursday’s (July 31) shareholder election deadline for cash/stock choices. The new Skydance-led regime is promising newsroom “ombudsman” oversight at CBS—an early indicator of culture-war pressures Hollywood faces under 2025-era regulation. Reuters

Eyes of Wakanda Moves Up

Marvel has quietly pulled its Black Panther spin-off forward to August 1, dropping all four episodes in a single Disney+ binge a week after Fantastic Four hits cinemas. The schedule shuffle compresses Marvel’s marketing window and could further blur film/series lines just as the MCU fights franchise fatigue. TechRadar

South Park Scores $1.25 B Streaming Pact

After marathon talks, South Park creators Trey Parker and Matt Stone have inked a five-year, $1.25 billion extension that hands exclusive global streaming rights to Paramount+, ending legal spats with Warner Bros. Discovery and Netflix. The deal gives the Skydance-bound studio a marquee adult-animation asset just as rivals scramble for sticky library IP. Reuters

Netflix Muscles Into Venice Lineup

This week’s Venice reveal shows three in-house Netflix awards plays—Noah Baumbach’s Jay Kelly, Guillermo del Toro’s Frankenstein, and Kathryn Bigelow’s A House of Dynamite—after the streamer sat out 2024. The move signals a return to festival-first Oscar strategy and intensifies questions about theatrical-window commitments amid the Paramount–Skydance shake-up. Vanity Fair

Week Ahead

Mon 28 Jul → Sun 3 Aug

SIGGRAPH 2025

Vancouver + virtual

Biggest R&D showcase for CG/VFX—look for AI-assisted pipelines, real-time ray-tracing demos and vendor courtships ahead of fall production greenlights.

SAG-AFTRA Meet-the-Candidates

Chicago, 6-8 pm CT

Board slate signals stance on 2026 Network Code and residual AI clauses—early read on labor temperature before next year's TV contract.

Spotify Q2 FY25

Pre-market

First clean read on audio-ads CPM rebound and audiobook attach rates after January price hike. Watch MAU vs. Premium delta.

Watch for Venice Sidebar Drops

No major dated items—keep an eye for last-minute Venice sidebar lineup drops; festival publicity offices have flagged "on or before 30 Jul" embargo windows.

AMC Entertainment Q2

Pre-market

Gauge U.S. box-office snap-back vs. concession spend; management's cash-flow guide shapes exhibitor capex.

Triple Opening Weekend

The Bad Guys 2, The Naked Gun, Omniscient Reader

Weekend mix will test family vs. nostalgia vs. K-novel quadrants.

SATURDAY

Beyond the Bar S1 (Netflix)

Benchmarks Netflix's mid-budget multi-cam comedy thesis.

SUNDAY

SIGGRAPH Production Sessions Climax

Final-day deal-making—studios often option tech demos for Q4 projects; have business-affairs on alert.

📊 THE WEEK: Earnings avalanche meets M&A milestones while SIGGRAPH showcases next-gen production tech.

Apple and Amazon Q2 Earnings Reveal Big Tech’s New Script for Hollywood’s Future

Big Tech’s New Entertainment Equation

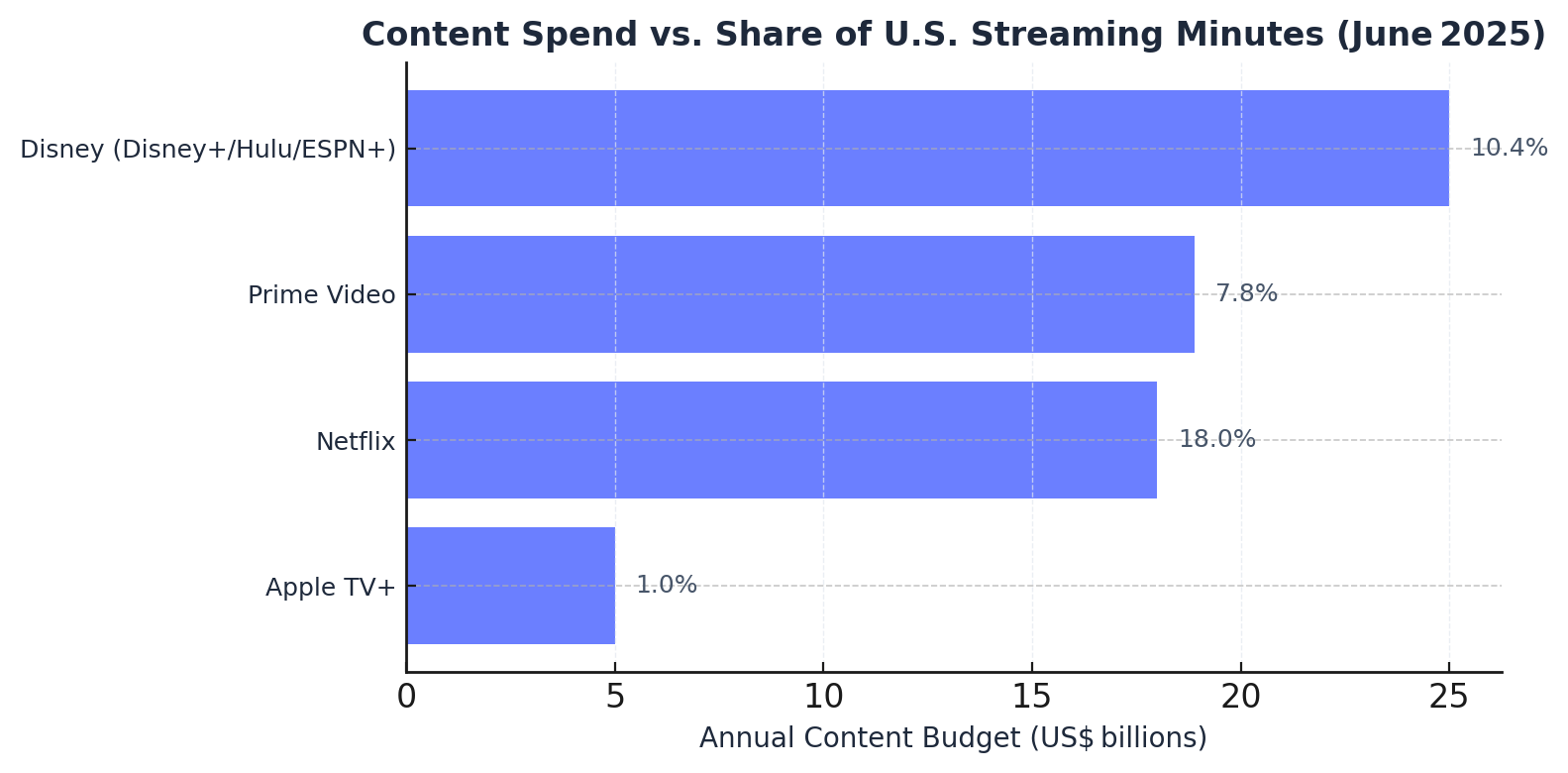

As Apple and Amazon prepare to report their Q2 2025 earnings on July 31, media executives are bracing for more than just numbers – they’re looking for signals of a strategic rewrite in Hollywood’s playbook. These tech giants’ financials are increasingly a bellwether for deeper shifts in entertainment: a pivot from the growth-at-all-costs streaming wars toward profitability, disciplined content investment, and hybrid monetization models. In the past, booming subscriber counts and content spending made headlines; now operating margin and return on investment share the spotlight . Apple and Amazon’s results, alongside updates from Netflix, Meta, and YouTube, illustrate an industry at an inflection point – one where profitability, audience behavior, and platform strategy are redefining how films and TV get made and monetized.

Apple: Services Strength vs. TV+ Costs

Apple’s June-quarter earnings are expected to show robust growth in its Services segment once again, after hitting a record $26–27 billion last quarter . The iPhone maker’s services business – which includes the App Store, Apple Music, iCloud and Apple TV+ – enjoys gross margins above 75% , far higher than its hardware profits. But beneath that glossy top-line is a revealing wrinkle: Apple TV+ remains a loss leader within Services, reportedly the only Apple subscription still in the red . Recent reports indicate Apple’s streaming service has been hemorrhaging over $1 billion annually, even after trimming its lavish content budget by $500 million in 2024 . With an estimated ~40 million subscribers – a fraction of Netflix’s 300+ million – Apple TV+ has yet to achieve the scale needed for standalone profitability.

Crucially, Apple’s Q2 earnings call and executive commentary will likely stress strategic patience over short-term payoff. Thanks to booming app and subscription revenues elsewhere, Apple can easily absorb TV+ losses . But even Apple’s wallet isn’t bottomless. CEO Tim Cook has begun scrutinizing costly projects (reportedly questioning a $200M film deal after it failed to draw subscribers) , and Apple’s now moving to instill old-school Hollywood rigor in its streaming venture. In a major shift, Apple TV+ is tying talent compensation to performance metrics – subscriber acquisition, viewership, cost efficiency – rather than the blank-check “cost-plus” model that defined the streaming boom . This return to profit participation echoes an earlier era and signals to creatives that hit shows will be rewarded, flops won’t. One graphic could illustrate Apple’s Services revenue vs. Apple TV+ costs over time, highlighting how a ~$100 billion/year services empire can bankroll content experiments – but also why Apple is now insisting that TV+ start pulling its weight .

Apple’s stance has broader implications for studios and producers. With Apple pushing some high-profile original films to wide theatrical release (in partnership with traditional studios) to build cultural impact and maximize returns, the old debate of theatrical vs. streaming is shifting toward a hybrid approach. Even tech players see cinema premieres as valuable – both for event marketing and a secondary revenue boost – before funneling content into the streaming ecosystem. Expect Apple’s earnings commentary to reinforce its commitment to quality-over-quantity in content, leveraging its high customer loyalty (over 1 billion active devices) to slowly grow Apple TV+ without the cash burn of competitors . For Hollywood, Apple’s model suggests that prestige content can thrive with disciplined spending and by bundling streaming as part of a larger ecosystem play (e.g. Apple One subscriptions and device integration) .

Amazon: Prime Video’s Pivot to Profit

If Apple’s journey is about measured subsidy, Amazon’s is about a mandate for self-sufficiency. Amazon’s Q2 2025 results will put a spotlight on its entertainment division as CEO Andy Jassy has explicitly set end of 2025 as the deadline for Prime Video to turn a profit . After years of pumping cash into originals (from art-house Oscar winners to global tentpoles like The Rings of Power), Amazon is retooling Prime Video’s strategy to align with its retail ethos: data-driven, cost-conscious, and diversified. One major shift, reflected in recent quarters, is a pivot toward live sports and advertising. Amazon is spending around $3 billion annually on sports rights – from Thursday Night Football to an NBA package – betting that live events with built-in audiences can drive reliable engagement and ad inventory in a way big-budget series couldn’t . In parallel, Amazon has quietly begun inserting ads into Prime Video (for instance, during NFL streams) and is considering an ad-supported tier, capitalizing on its strength in targeted advertising . The Q2 earnings may show initial dividends of this approach, with higher Prime engagement and advertising growth offsetting content costs.

Another prong of Amazon’s profitability push is turning Prime Video into the “everything store” of streaming. Through its Channels marketplace, Amazon now resells rival streaming services inside Prime Video – and remarkably, this hub drives about 25% of all U.S. streaming sign-ups for partners like Max and Paramount+ . By taking a cut of those subscriptions, Amazon earns revenue without heavy content spend, and keeps viewers within its platform. In fact, Amazon’s leaders tout Prime Video as a one-stop destination outmaneuvering even Netflix and YouTube on this front . This aggregator strategy was evident in Q2 trends: Apple TV+ even joined Prime Channels last fall , and Amazon’s data shows being on its platform boosts partners’ subscriber acquisition . A suggested chart could plot Prime Video’s content spend (around $7 billion in 2024) vs. its revenue contributions, showing the gap Amazon aims to close . Another could track Amazon’s investment mix over time – originals vs. sports vs. licensing – illustrating a deliberate tilt toward assets that can pull in broad audiences or incremental revenue. The key message from Amazon’s earnings: unlike the early streaming wars where user growth was the sole metric, now efficiency and monetization are king. For studios, this means pitching a pricey genre series to Amazon might face higher scrutiny unless it can also drive Prime subscriptions or serve other business goals (like retail synergy or international expansion). Conversely, sports and franchise IP (where Amazon can amortize costs across games, merchandise, and global markets) will find Amazon an eager buyer.

Industry Ripples: Ad Dollars, Windows, and Creators

The financial discipline embraced by Apple and Amazon echoes across the industry. Netflix, the once free-spending pioneer, has already transitioned to prioritizing free cash flow and operating margins (targeting ~29% by mid-decade) . Notably, Netflix’s own Q2 updates showed healthy revenue growth (~12% YoY) despite slower subscriber gains, thanks in part to price hikes and a successful rollout of an ad-supported tier . Netflix plans to spend a hefty $18 billion on content in 2025 , but it’s funding that by squeezing more value from each subscriber (cracking down on password sharing and introducing advertising). In effect, Big Tech’s earnings are proving that streaming is maturing into a sustainable business, not just a land grab. Profitability now matters, and that changes everything from deal-making to release strategies.

Meanwhile, the advertising resurgence is reshaping entertainment economics. Google’s Q2 report is expected to show YouTube ad revenue nearing $10 billion for the quarter , continuing a trend from Q1 when YouTube ads jumped 10% year-on-year to $8.9B . Similarly, Meta – parent of Facebook and Instagram – saw a 16% surge in ad income in Q1 2025 , buoyed by platforms like Reels video that are capturing massive user attention. These figures signal that audiences (and advertisers) are flocking to digital video in all forms, not just prestige TV and films. For studios, robust ad growth on YouTube and social media is a double-edged sword: on one hand, it validates ad-supported streaming models (spurring Hollywood’s embrace of FAST channels and cheaper ad tiers for services like Disney+ and Max). On the other, it means the competition for eyeballs is fiercer than ever – a Gen Z viewer might spend hours on creator-driven YouTube content (which costs Hollywood nothing to produce) instead of watching a big-budget series. The lesson from Q2 earnings is that attention is a finite currency. Big Tech’s platforms (from Prime Video to YouTube to Instagram) are vying to be the default venue for consumer eyeballs, and whoever wins that war will dictate how content gets distributed and paid for.

One graphic to drive this home could chart annual ad revenue of YouTube and Meta vs. traditional TV ad revenue or vs. streaming subscription revenue. The visual would likely show YouTube’s yearly ad haul (projected $35B+ ) dwarfing the streaming industry’s subscription revenues. This imbalance has real implications: it pushes Hollywood studios to reconsider windowing and licensing. For instance, the old instinct to hoard content exclusively on one’s own platform is fading – if a licensed deal with Amazon or a free streaming outlet can bring a new audience (and millions in revenue), content owners are increasingly game. We’ve seen Warner Bros. license HBO shows to Netflix, and Paramount explore third-party deals, signaling a pragmatic shift that earnings calls are reinforcing. When growth slows, monetization trumps exclusivity.

The upcoming Apple and Amazon earnings reports are more than quarterly scorecards – they’re signposts of a new equilibrium in film and television. Big Tech’s deep pockets are still funding bold content moves, but investors’ insistence on returns is reining in the excess. The result is a more balanced industry calculus: mix prestigious originals with broader-audience content, blend subscription revenue with advertising, leverage theatrical windows when advantageous, and keep a keen eye on cost vs. engagement. For media executives, this is the new normal. The era of streaming’s blank checks is over; the era of strategic, sustainable storytelling – backed by both data and creative vision – is beginning. Hollywood’s future will be shaped as much by Q2 earnings calls and investor demands as by the talents of writers, directors, and stars. In that sense, the business of entertainment is now as front-and-center as the art of it, and everyone from studio chiefs to indie creators will need to adjust their scripts accordingly.

Ask Back

Have a question you’d like us to dig into next week — a release to watch, a trend to track, or a topic that’s flying under the radar? Just hit reply and let us know. We’ll take on as many as we can in the next edition.

Enjoy the week ahead — we’ll see you Friday.