Apple just made the biggest fantasy IP deal since Game of Thrones. This week: Brandon Sanderson's Cosmere lands at Apple TV+, Markiplier's Iron Lung hits theaters, and the webtoon pipeline goes mainstream.

Bradley Hope

27 posts

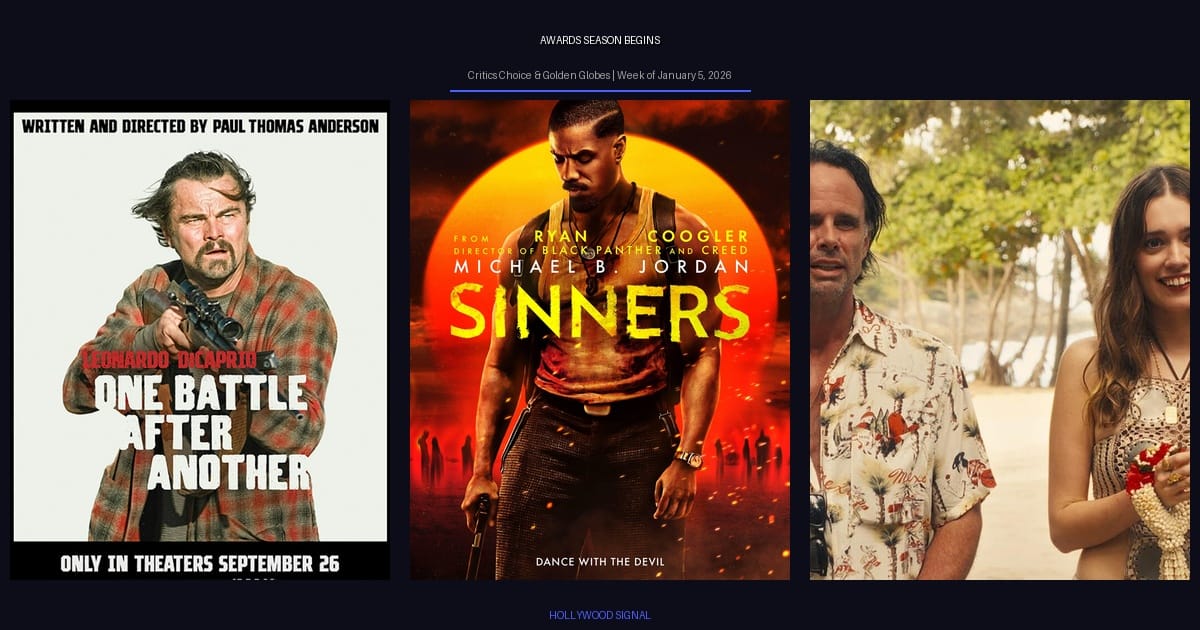

This week: Sinners breaks Oscar record with 16 nominations, Wicked gets zero, and the Academy goes global.

Fresh IP, deals, and adaptation opportunities from this week in Hollywood.

The Golden Globes have reshuffled the Oscar deck. Here's what the results mean for the road to the Academy Awards, plus Sundance preview and this week's releases.

This week: A bombshell true-crime podcast, surprisingly available video game rights, and haunting historical mysteries.

This week: The Housemaid becomes Lionsgate's biggest hit since Hunger Games, SAG-AFTRA won't rule out a strike, and 365 buttons becomes 2026's first viral trend.

This week, the industry pivots from the holiday box office to the kickoff of awards season, with two major ceremonies set to define the early Oscar contenders. Meanwhile, HBO and other streamers are rolling out their first big plays of the new year.

Subscribe now!

Hollywood Signal is the anti-gossip newsletter for decision-makers — distilling market data, buyer mandates, and trend analytics into a weekly briefing that helps execs, producers, and creators green-light, pitch, or pivot.

Join now!